Venture Building Investment

Venture Building Investment

Investing in Your Investment

United Social Ventures supports innovative social entrepreneurs in the fund raising journey to the first $1M.

Our thesis is that, by acting as a mediator between founders and funders, we can: (i) get ventures to a more advanced stage prior to financing, and (ii) encourage investors to provide capital earlier.

We do this through our unique “IVF” method:

Investing in Your Investment

United Social Ventures supports innovative social entrepreneurs in the fund raising journey to the first $1M.

Our thesis is that, by acting as a mediator between founders and funders, we can: (i) get ventures to a more advanced stage prior to financing, and (ii) encourage investors to provide capital earlier.

We do this through our unique “IVF” method:

United Social Ventures is a nonprofit, so our pricing is designed to not be a barrier to access for any founder.

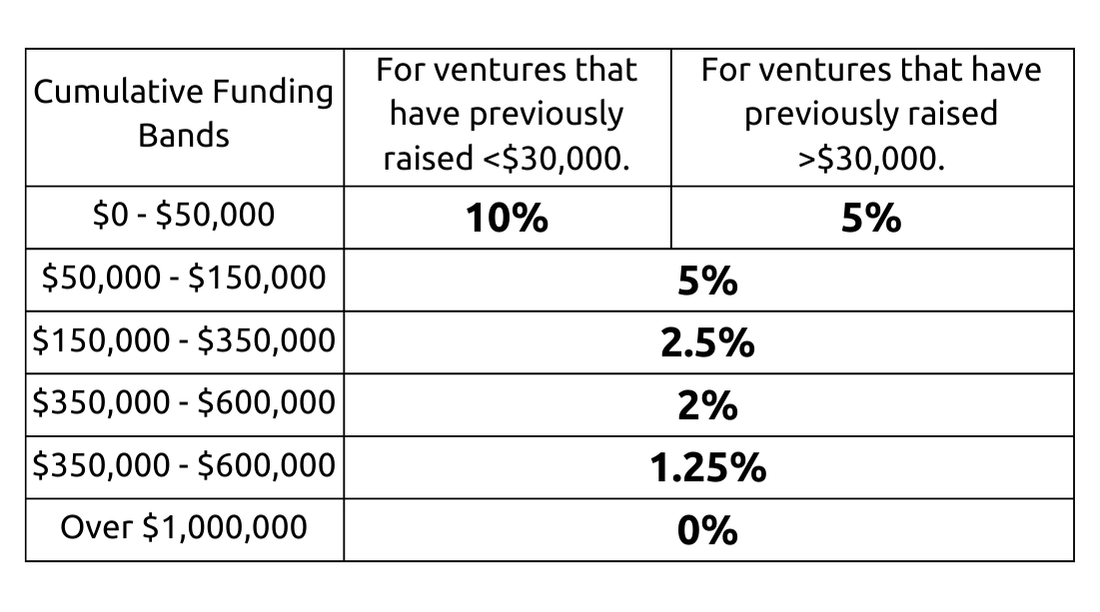

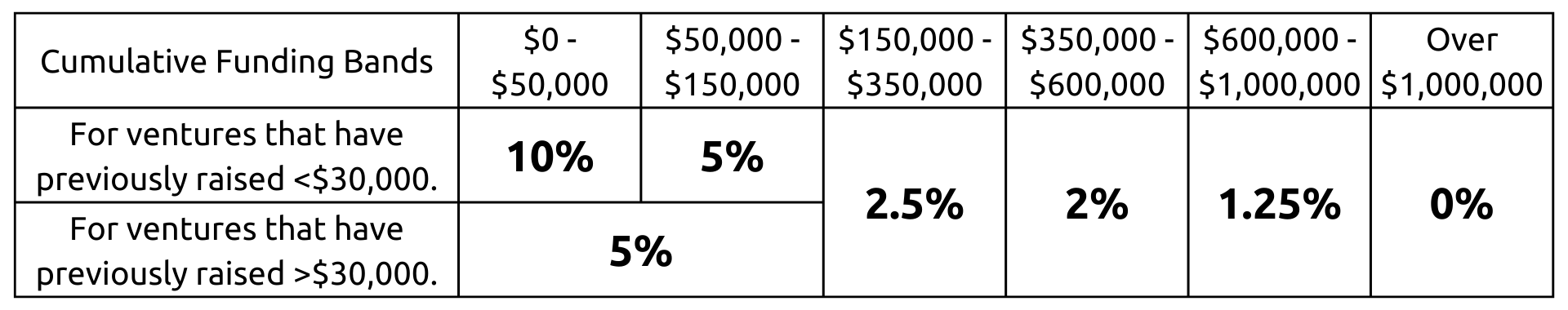

Ventures pay an upfront commitment fee of $100, and sign a contract to pay USV a percentage of financing raised up to $1M.

United Social Ventures is a nonprofit, so our pricing is designed to not be a barrier to access for any founder.

Ventures pay an upfront commitment fee of $100, and sign a contract to pay USV a percentage of financing raised up to $1M:

Weekly prototyping plans are created for founders with 3-5 rapid tests designed to change the confidence in all the key assumptions underlying the ventures model.

The number of weeks of prototyping plans can be between 5 and 25, depending on a venture’s funding needs and their pace of testing.

Completion of this process not only validates ventures’ business and impact models, but also the commitment and initiative of their founders.

Weekly prototyping plans are created for founders with 3-5 rapid tests designed to change the confidence in all the key assumptions underlying the ventures model.

The number of weeks of prototyping plans can be between 5 and 25, depending on a venture’s funding needs and their pace of testing.

Completion of this process not only validates ventures’ business and impact models, but also the commitment and initiative of their founders.

USV compiles data collected from ventures into historical financial and impact data. We use this to create decks, financial projections, and data rooms.

Once validation is reached, we share these documents in personal messages with funders in our network who match in terms of deal size and sector.

The introduction by USV greatly increases the probability that ventures are reviewed, and ultimately raise capital.

USV compiles data collected from ventures into historical financial and impact data. We use this to create decks, financial projections, and data rooms.

Once validation is reached, we share these documents in personal messages with funders in our network who match in terms of deal size and sector.

The introduction by USV greatly increases the probability that ventures are reviewed, and ultimately raise capital.

182

$6.7+ M

272

182

$6.7+ M